What Is a Pipeline Review?

A pipeline review is not a forecast call. A forecast call is about committing to a number, focusing on what will close this quarter, and why the business is above or below target. A pipeline review is upstream of the forecast call. It’s a recurring meeting that evaluates the health, progression, and sufficiency of the entire pipeline. A forecast call is anchored to the current quarter. A pipeline review looks out beyond the average sales cycle length. In this guide, we’ll walk through how to run a pipeline review as a RevOps leader.

It’s an essential mechanism for RevOps and sales leadership to predict the future, hold teams accountable, and correct course before targets slip.

Pipeline review types by level:

- Rep + Manager (weekly): Opportunity inspection, CRM hygiene, coaching

- Manager + Director (bi-weekly): Stage velocity, sufficiency, enablement gaps

- VP + RevOps (monthly/quarterly): Segment trends, pipeline pacing, cross-functional blockers

“The pipeline you create today is what you close tomorrow. If you’re not building now, you’re already behind.” — Vlad Khazanovich, Principal GTM Strategy Manager, Expel

“Every revenue leader I’ve worked with wants to run pipeline reviews differently. The key is adapting the format by level—first-line managers need coaching and pipeline hygiene reminders, while execs want strategic pacing and risk signals.”— Giulio Magni, Head of RevOps at Stability AI

“RevOps should design these forums to reinforce CRM discipline, encourage productive coaching, and feed actionable data into forecast and planning loops.” — Yoni Spitzer, VP of Operations and Head of RevOps at Coro

Why Do Pipeline Reviews Matter?

1. Support Forecast Accuracy

A pipeline review is not a forecast call, but it is a forecast input. Forecast meetings are where the number gets called, while pipeline reviews are where the inputs get validated. Pipeline reviews inspect whether the deals in the funnel are legitimate, before they are included in a forecast. They also build discipline across teams, ensuring reps update fields and managers are asking better questions. They force a regular audit of reality.

“Disciplined weekly deal inspection is what feeds reliable forecasts to the board.” — Yoni Spitzer, VP of Operations and Head of RevOps at Coro

2. Accelerate Deal Velocity

Pipeline reviews surface stuck deals and prevent stage rot. Reps are held accountable for momentum and managers can coach proactively.

3. Spot Risk and Gaps Early

Missed coverage targets, over-reliance on a single channel, and signs of pipeline decay show up first here, not in the forecast. If pipeline isn’t growing, leaders must investigate and act. Is it talent? Tooling? Budget? Strategy?

“You catch risk when it’s still correctable—not after it blows up the forecast. That’s the real value of weekly pipeline review.” – Yoni Spitzer, VP of Operations and Head of RevOps at Coro

4. Drive CRM Accountability

If it’s not in the CRM, it didn’t happen. Regular reviews build the muscle of clean data and up-to-date deal hygiene.

“The managers that drive consistent results are the ones showing the CRM screen during weekly meetings and holding reps accountable inside the system—not in spreadsheets.” — Giulio Magni, Head of RevOps at Stability AI

5. Align Cross-Functional Revenue Planning

Pipeline reviews connect the dots: outbound performance, inbound volume, channel partner success, and marketing ROI all come into view. Pipeline reviews are a natural forum for GTM alignment and resource planning based on data, not gut feel.

Vlad’s company, Expel, includes all teams in the pipeline review: Sales, BDRs, Marketing, CX, and even Partnerships. Each source is responsible for pipeline targets just like sales is for revenue targets.

6. Inform Strategic Decisions

Trends in stage conversion, segment win rates, or opportunity slippage help RevOps recommend pricing, segmentation, or resourcing adjustments.

The Anatomy of a High-Quality Pipeline Review

A pipeline review is only valuable if it drives the business forward. That starts with knowing what to inspect, what’s worth discussing, and what action to take. Without these tangible actions in mind, pipeline reviews can devolve into a low-energy data read-out that barely impacts the business. That’s when stakeholders stop showing up and RevOps becomes viewed as an admin, not a strategic partner.

What to Review

Pipeline Coverage

What it means:

How much pipeline exists relative to target (broken down by rep, segment, or region) and categorized by forecast category (e.g. commit, best-case, pipeline). Historically, SaaS businesses targeted 3-4x coverage (meaning you need 3-4x of your revenue goal in pipeline), although recent discourse has ticked this number up to 5x. Coverage is usually the inverse of your win rate (for example, if your win rate is 25%, you’ll close a quarter of your pipeline, hence the 4x coverage benchmark).

Why it matters:

Coverage shows whether you’re on track to meet bookings goals in this or future quarters. It also highlights whether coverage is spread evenly or concentrated in a few reps or deals. It takes time to build pipeline and to close pipeline into deals (sales cycle). If you get caught short of pipeline, it can take a long time for the business to recover.

How to do it well:

- Start with total coverage (e.g. 3–4x target), then break it down: late-stage vs. early-stage, inbound vs. outbound, AE vs. SDR sourced.

- Use weekly snapshot data to benchmark against historical pacing and conversion at this time in the quarter/year.

- Review per rep and segment to catch underperformance before it snowballs.

“We look at late-stage vs. total coverage and benchmark against historicals using snapshot data. That tells us where we’re trending and where to intervene.” — Vlad Khazanovich, Principal GTM Strategy Manager, Expel

Deal Movement

What it means:

Changes to pipeline since the last review: what was added, what advanced, what stalled, what slipped, and what was lost.

Why it matters:

You can’t manage what you don’t track. Movement shows progression, leakage, and inefficiency. Lack of movement shows what’s being neglected or low-quality. This prompts discussion around the GTM process, enablement, and how much of the pipeline is actually “real.”

How to do it well:

- Build a pipeline waterfall: count and value of new opps added, opps progressed, opps pushed, and opps closed (won/lost).

- Focus on push rate and repeat pushers. Deals that keep slipping are red flags.

- Cross-reference with sales notes and activity data to flag ghost pipeline.

“Every week, you should be able to answer: what advanced, what stalled, and what needs help?” – Yoni Spitzer, VP of Operations and Head of RevOps at Coro

Stage Conversion

What it means:

How efficiently deals move from one stage to the next, plus where they drop off.

Why it matters:

Poor conversion rates signal process gaps, bad fit opps, or skill issues. Stage velocity shows where deals slow down or get stuck.

How to do it well:

- Build a funnel view that tracks entry rate, exit rate, and time spent in each stage.

- Focus on conversion bottlenecks (e.g., high drop-off from discovery to evaluation).

- Segment by deal type, source, or region to identify patterns.

Use this to coach reps, redesign qualification, or recalibrate stage definitions.

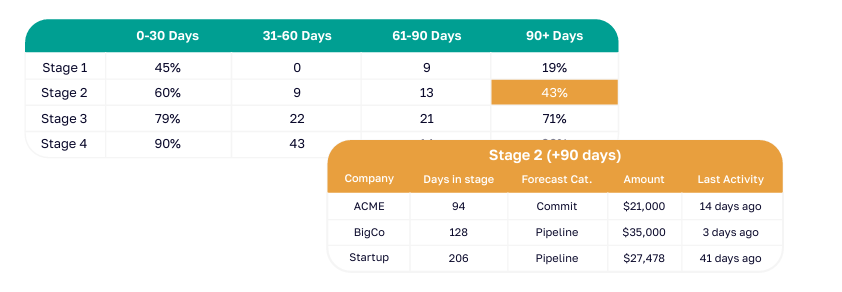

Opportunity Aging

What it means:

How long opportunities have been sitting in the pipeline, and how long they’ve been in their current stage.

Why it matters:

Deals that linger too long without movement are either dead or being avoided. Aging shows which ones need inspection, escalation, or disqualification.

How to do it well:

- Use age buckets: 0–30 days, 31–60, 61–90, 90+.

- Compare with average cycle length for your segment or product.

- Highlight opps with no activity in the last 14–30 days.

This is where CRM discipline becomes evident. Outdated close dates, no logged activity, or over-aged deals should be flagged and addressed during the review.

What to Discuss

The goal of the discussion isn’t to rehash every deal, but rather to focus on friction. Most high-functioning pipeline reviews focus on four things:

1. Deals That Need Support

- Which deals are stuck?

- What’s blocking progress: procurement, pricing, technical objections?

- Who needs to get involved: deal desk, executive sponsor, product, finance?

This discussion helps allocate resources in real time and gets roadblocks removed faster.

2. Pipeline Creation vs. Plan

- Are we pacing toward our coverage goals for next quarter?

- How are pipeline sources performing (SDR, AE outbound, marketing, channel, CSM)?

- Which segments are under-generating?

This is where you hold each source accountable. Not just sales. It also helps justify budget reallocations or program changes if a channel isn’t working.

3. Segment or Region Gaps

- Are certain verticals, segments, or territories under-covered or underperforming?

- Are win rates or average deal sizes off target in specific areas?

- Do we have localized coaching, enablement, or messaging needs?

This identifies structural gaps that can’t be solved by individual rep execution.

4. Cross-Functional Issues

- Are marketing campaigns driving the right pipeline? Are these leads actually converting to pipeline and closed won deals?

- Are enablement materials being used or ignored?

- Are handoffs between SDRs, AEs, and CS breaking down?

This is where pipeline reviews become a coordination tool. The recurring nature of the meeting ensures that stakeholders discuss and solve problems in real-time, not just at quarter-end.

What to Act On

Every good pipeline review ends with action. Otherwise, it’s just theater. The follow-through determines whether the insights translate into better results. And this is where RevOps can make a big impact.

Here’s what to leave the room with:

1. Assign Executive or Deal Desk Support

If an at-risk deal needs unblocking (like legal, pricing, or procurement) get it assigned. Don’t let reps shoulder that alone.

2. Trigger Targeted Pipeline Campaigns

If a segment is light, or coverage is poor for next quarter, assign marketing or outbound to fill that gap, quickly. This could mean fast-turn campaigns, 1:1 ABM, or refresh lists for SDRs.

3. Update Enablement Plans

If the same objections keep killing deals, or a certain stage is leaking, enablement needs to step in. This includes new talk tracks, updated battlecards, or role-specific training.

4. Adjust CRM Process or Field Logic

If reps are skipping fields, misclassifying deals, or misunderstanding stage definitions, RevOps should refine the CRM config. Add validation rules, streamline stage criteria, or improve tooltips.

“We treat pipeline reviews as a forcing function. If AE outbound is behind, we dig into why. If it’s tooling or enablement, we fix it. If it’s discipline, we escalate.” — Vlad Khazanovich, Principal GTM Strategy Manager, Expel

Meeting Structure: Cadence and Format

- Weekly: Team-level tactical reviews led by managers

- Monthly: Strategic pipeline pacing and cross-functional alignment

- Quarterly: Segment-level trends, capacity modeling, and strategic planning

Common agenda structure:

- RevOps readout: pipeline coverage, pacing vs. target, historical benchmark, week-over-week changes

- Sales leader segment update: where we stand and what’s moved

- Pipeline source updates: marketing, SDR, AE outbound, CSMs, partners

- Discussion: gap identification, support needed, course correction, key action items

“We use a standardized script for each pipeline source leader. It ensures everyone shows up prepared and can speak to the numbers.” — Vlad Khazanovich, Principal GTM Strategy Manager, Expel

“First-line pipeline reviews should happen weekly. But for execs, it’s not about deal details—it’s about seeing progress against goals and building pipeline toward the next quarter.” — Giulio Magni, RevOps Leader at Stability AI

“The best VPs I’ve worked with set the format. They say, ‘Here’s how I want pipeline and revenue shown, so I can take it to the board.’ Then they cascade that down.” — Giulio Magni, Head of RevOps at Stability AI

“Quarterly reviews are where trends become strategy. That’s when RevOps needs to come with insights, not just dashboards.” — Yoni Spitzer, VP of Operations and Head of RevOps at Coro

The RevOps Analytics That Power It

Pre-Meeting Preparation

- Validate CRM hygiene: no missing next steps, incorrect close dates, or $0 values

- Snapshot pipeline by segment, stage, owner

- Highlight week-over-week deltas

- Flag aging, at-risk, or slipped deals

Dashboards to Build

If you want pipeline reviews to drive decisions, you need the right analytics infrastructure. That doesn’t mean 20 dashboards with 80 filters. It means five to seven purpose-built views that surface the most important trends and risks without making your managers hunt for takeaways.

Below are the dashboards every RevOps team should build, what they’re used for, and how to configure them.

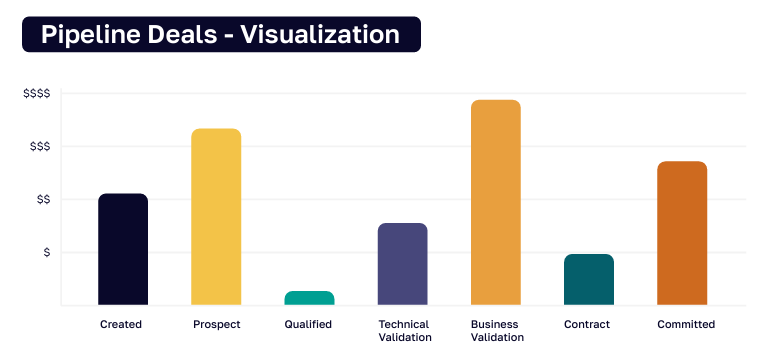

1. Pipeline by Stage and Source

What it shows:

Breakdown of pipeline volume (by count and dollar value) across deal stages, segmented by origin source (SDR, AE, channel, CSM, marketing, etc.).

Why it matters:

You want visibility into where pipeline is coming from and how far it’s advancing. It’s your earliest warning system for pipeline shortfalls by source.

How to build it:

- X-axis: Source of pipeline (using a multi-select field like Pipeline Source or Created By)

- Y-axis: Pipeline amount (or count of opps)

- Color grouping: Deal stages

- Filters: Region, segment, owner, timeframe

- Tooling: Salesforce, Tableau, or AccountAim. Snapshotting is helpful if you want to track changes over time.

Use it to:

- Spot early-stage pileups by source (e.g., SDR-sourced opps not progressing)

- Compare AE vs. SDR contribution to mid-funnel

- Justify investment in underperforming or outperforming channels

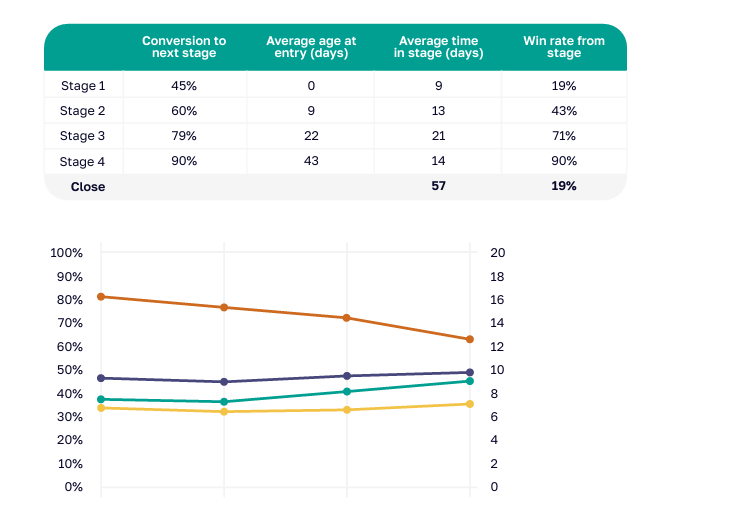

2. Conversion Rates and Stage Velocity Over Tim

What it shows:

How efficiently opportunities move from one stage to the next, and how long they stay in each.

Why it matters:

Bottlenecks and drag in the sales cycle kill forecasts. This dashboard isolates where and when that happens.

How to build it:

- Table format or funnel view:

- Rows = Stage transitions (e.g., Stage 1 > Stage 2)

- Columns = Metrics like conversion %, avg time in stage, avg age at entry, win rate from that stage

- Rows = Stage transitions (e.g., Stage 1 > Stage 2)

- Time filters: Rolling 90 days or by quarter

- Tooling: BI layer (Looker, Tableau, Sigma), CRM reports with custom calculations, or AccountAim

Use it to:

- Identify conversion drops (e.g., strong create rate but poor Evaluate > Proposal)

- Understand time drag (e.g., deals stall 22 days in Stage 3)

- Coach reps on where they’re getting stuck and qualify deals faster

3. Pipeline Movement Waterfall: Adds, Slips, Closes

What it shows:

Period-over-period changes to the pipeline: what’s new, what’s pushed, what’s closed won/lost.

Why it matters:

Managers need visibility into how the funnel is changing, not just its current snapshot.

How to build it:

- Rows: Pipeline change category (slipped, lost, created, pulled in, etc.)

- Columns: pipeline change value in the period

- Tooling: Requires snapshotting or tracking via Opportunity History in SFDC; easier with tools like Clari or AccountAim

Use it to:

- Flag at risk deals

- Understand the path to hitting your pipeline coverage goals

- Catch repeated slippage (and correlate with forecast misses)

- Understand pipeline volatility and stability by owner

4. Pipeline Aging Buckets

What it shows:

How long opportunities have been sitting in the funnel, grouped into aging categories.

Why it matters:

Old pipeline isn’t necessarily bad, but it needs scrutiny. Aging analysis helps clean up inflated forecasts and stalled deals.

How to build it:

- X-axis: Aging buckets (e.g., 0–30 days, 31–60, 61–90, 90+)

- Y-axis: Count or value of opportunities

- Optional: Split by forecast category or stage

- Filters: Rep, region, deal size, product line

- Tooling: SFDC formula fields, BI layer, or AccountAim

Use it to:

- Surface neglected or zombie deals

- Pressure test forecast pipeline with high-age opps

- Prompt manager reviews on anything past 90+ days with no progress

5. Win/Loss Breakdown by Segment and Reason Code

What it shows:

Closed-won and closed-lost deals grouped by market segment and categorized reason.

Why it matters:

Understanding why you win or lose—and in which segments—is the foundation of both pipeline quality and strategic planning.

How to build it:

- Matrix view:

- Rows = Market segment (e.g., SMB, MM, Enterprise) or lead source (AE, SDR, events, etc.)

- Columns = Win rate, average deal size, most common loss reasons

- Rows = Market segment (e.g., SMB, MM, Enterprise) or lead source (AE, SDR, events, etc.)

- Optional graphs:

- Pie or bar chart for top 5 loss reasons

- Line graph for win rate over time by segment

- Pie or bar chart for top 5 loss reasons

- Requires: A standardized Loss Reason picklist in CRM

Use it to:

- Optimize ICP definitions and segmentation

- Adjust positioning or enablement for specific buyer personas

- Provide strategic feedback to product, marketing, or CS

Technical Infrastructure Required

- Defined CRM stages with required fields and validation rules

- Weekly opportunity snapshotting for trend reporting

- BI or analytics layer for modeling (like AccountAim)

- Attribution logic agreed across teams and visible in CRM

“You can’t run these reviews without snapshot data. We track pipeline creation and coverage weekly using Salesforce snapshots and Google Sheets models.” — Vlad Khazanovich, Expel

“Dashboards should be live and filterable by rep, team, and region. Static slides slow everything down.” — Yoni Spitzer, Coro

Static slides kill momentum. Use live dashboards in Salesforce, AccountAim, or Clari so you can explore the data in real time – Yoni

Common Pitfalls to Avoid

Process Pitfalls

- Micromanagement tone instead of coaching

- Mixing performance reviews or team updates into the agenda

- No clear follow-ups or accountability

Fix: Use a standardized script, track actions in CRM, and keep reviews focused

Data Pitfalls

- Incomplete CRM fields

- Too many metrics muddying the signal

- Misaligned definitions (e.g. what counts as an opportunity)

Fix: Limit KPIs to 5–7 high-impact metrics and align on definitions in RevOps onboarding

Cultural Pitfalls

- Blame culture: leaders use data to punish, not coach

- Lack of ownership: if pipeline is weak, someone needs to be able to explain why

- Low adoption: leaders skip reviews or don’t prepare

- CRM avoidance: reps track pipeline in spreadsheets

Fix: Set the tone from the top, highlight wins, and make CRM hygiene a shared priority

Measuring Pipeline Review Effectiveness

RevOps teams should monitor pipeline reviews like they do sales metrics. These meetings aren’t a check box. They should drive better revenue outcomes. This will also help you show RevOps ROI.

Track these indicators over time:

1. Forecast Accuracy

- Track the delta between forecast (commit + best-case) and actual revenue closed.

- Review accuracy by team, region, or product line.

- Over time, improved accuracy shows that reviews are driving better qualification and risk management.

Target: ≤10% variance between commit and actuals across multiple quarters.

2. CRM Hygiene & Pipeline Quality

- % of opportunities with complete key fields: stage, close date, amount, next step, last activity.

- % of pipeline with stale data (e.g. overdue close dates or no activity in 30+ days).

- Use hygiene dashboards by rep or region to track improvement over time.

Target: 90–95% field completeness and <10% stale deals.

3. Sales Execution Metrics

- Win Rate: Is the win rate for reviewed deals trending upward?

- Deal Velocity: Is average time to close and stage duration improving?

- Push Rate: Are fewer deals repeatedly slipping close dates?

Target: Reduce slippage by 15–25% and shorten cycle time by 10–20% over two quarters.

4. Pipeline Sufficiency & Stage Conversions

- Is pipeline coverage staying within healthy ranges (3–4× quota)?

- Are stage-to-stage conversion rates improving post-review coaching?

- Is next quarter’s pipeline being built proactively?

Target: Maintain at least 3× coverage and increase mid-funnel conversion QoQ.

5. Engagement & Cadence Adherence

- % of pipeline reviews happening on schedule, and with updated CRM inputs.

- Are reps showing up prepared? Are managers using dashboards effectively?

- Is there visible follow-up on prior action items?

Target: >90% adherence; supplement with quarterly RevOps pulse checks or surveys.

6. Strategic Follow-Through

- Are trends from pipeline reviews influencing marketing campaigns, enablement initiatives, or sales plays?

- Track how often pipeline reviews lead to downstream actions like deal desk involvement, exec escalation, or GTM realignment.

“If your pipeline reviews aren’t surfacing strategic conversations—like where to invest marketing dollars or where deals are getting stuck—then you’re just checking boxes.” — Giulio Magni, RevOps Leader, Stability AI

“You should be able to tie pipeline review rigor to better forecast accuracy, cleaner CRM, and shorter deal cycles. If not, something’s off.” – Yoni Spitzer, VP of Operations and Head of RevOps at Coro

In Conclusion

Pipeline reviews are an essential GTM cadence. Pipeline is the lifeblood of a growing businesses, and usually the #1 challenge at any given time. Running a productive, impactful pipeline review process is the highest leverage thing a RevOps team can do. It requires solid data management, good analytics, effective stakeholder management, and prep work – all reasons that so many companies don’t do a good job with it. But if you nail this process, you’re on your way to creating a strategic impact for your business. If we at AccountAim can be helpful in any way, don’t hesitate to reach out!