Most GTM teams rely on pipeline reports and topline revenue numbers to guide strategy. But those numbers can be deceptive. Hidden churn, stalled expansion, or bad-fit customers often stay invisible until it is too late.

Cohort analysis cuts through the noise. It is a strategic tool for RevOps, CROs, and GTM leaders who care about revenue quality, retention, and sustainable growth.

What is cohort analysis for GTM teams

Cohort analysis breaks down customer behavior over time based on shared characteristics like acquisition month, purchased product, or customer segment (e.g. region, deal size, industry).

In RevOps, the most common approach is monthly acquisition cohorts, tracking customers who first converted in the same month. These cohorts are monitored over time using ARR waterfall logic to understand how retention, expansion, churn, and net growth evolve.

“The ARR Waterfall is the secret weapon that powers strategic revenue growth.” — Will Sullivan, Managing Partner at Predictive Analytics Partners

Cohort analysis visualizes whether customers stick around, expand, or quietly churn. It turns opaque revenue data into clear signals about what is working and what is not.

Why cohort analysis matters in GTM

Cohort analysis provides a forward-looking GTM operating system that goes beyond retrospective analysis.

- Track revenue quality. Not all growth is healthy. Cohorts reveal whether growth is sustainable or fragile.

- Example – a SaaS company might notice that customers acquired via inbound in Q2 2023 have 25% higher expansion rates than those acquired via outbound, indicating stronger deal quality from inbound channels.

- Example – a SaaS company might notice that customers acquired via inbound in Q2 2023 have 25% higher expansion rates than those acquired via outbound, indicating stronger deal quality from inbound channels.

- Diagnose product-market fit issues. If cohorts churn early or fail to expand, it flags a PMF problem tied to pricing, product gaps, or operational misalignment.

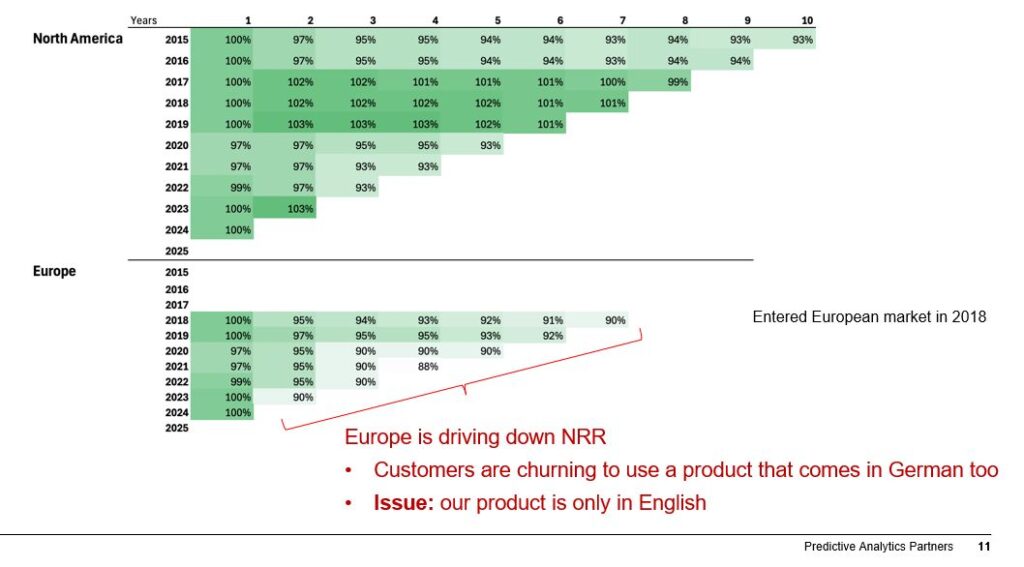

- Example – a SaaS company expanding into EMEA might find that the cohort from Q1 2024 churns at a much higher rate due to the product lacking GDPR compliance or language localization.

- Example – a SaaS company expanding into EMEA might find that the cohort from Q1 2024 churns at a much higher rate due to the product lacking GDPR compliance or language localization.

- Measure GTM changes. Test whether pricing adjustments, onboarding updates, or sales process shifts are improving outcomes based on newer cohort performance.

- Example – if after launching a new onboarding process in July 2023, the August and September cohorts show a 15% increase in 90-day retention compared to previous cohorts, it signals that the onboarding improvements are working.

- Example – if after launching a new onboarding process in July 2023, the August and September cohorts show a 15% increase in 90-day retention compared to previous cohorts, it signals that the onboarding improvements are working.

- Surface hidden risks. Topline revenue might look fine while recent cohorts underperform quietly. Cohort analysis exposes this early. It highlights slipping retention in newer cohorts, slower expansion rates over time, and problems that are masked by growth elsewhere in the business.

- Example – while total ARR may grow due to upsells in legacy customers, a cohort analysis might reveal that customers acquired through a recent outbound motion have 30% lower net retention, signaling a hidden risk that could impact future growth.

- Example – while total ARR may grow due to upsells in legacy customers, a cohort analysis might reveal that customers acquired through a recent outbound motion have 30% lower net retention, signaling a hidden risk that could impact future growth.

“The easiest and most efficient way to grow revenue is to sell more to your existing customers, which is why net retention is so important. And this framework allows us to drive performance, expansion, and customer retention. When you look at it from a multidimensional aspect of market segment, vertical cohort, sales motion, lead source, you can really understand go-to-market effectiveness.” — Will Sullivan

How GTM and RevOps teams should use it

Here is how high-performing RevOps and GTM teams operationalize cohort analysis.

- Create vintage cohorts. Group customers by acquisition month or quarter.

- Track over time. Measure gross retention, net retention, and expansion rate for each cohort.

- Slice by segment. View performance by region, sales motion, customer type, or lead source.

- Benchmark health. Spot at-risk cohorts quickly by flagging low retention or weak expansion early.

- Feed insights into planning. Use cohort data to improve forecasts, refine ICP, and adjust GTM investments.

“You can build this in AccountAim. It allows you to do a simple monthly vintage cohort analysis. You can calculate the gross retention, then take the cuts by segment. The beauty of having a tool like AccountAim is you can go in there and add different cuts, do segmentation, do verticals.” — Will Sullivan

Benefits of cohort analysis for GTM teams

- Early churn detection. Spot retention risks before they impact topline revenue.

- Improved forecasting accuracy. Forecast using real cohort behavior instead of relying only on pipeline assumptions.

- Smarter GTM investments. Double down on high-performing regions, products, and motions while correcting weak areas.

- Faster feedback loops. Evaluate if pricing, onboarding, or sales process changes are working within months, not years. See the impact of GTM experiments (e.g. new bundles, onboarding, discounts).

- RevOps-finance alignment. Create a shared, factual view of revenue performance that bridges operations and finance. Cohort views help explain why performance looks a certain way, not just what happened.

“You can analyze the customer journey at scale by understanding what the customer is doing. This enables you to understand if Product B is the right fit for this customer persona or this market. And when you analyze that at scale, you start to get into some strategic understanding of the market and the segment.” — Will Sullivan

Cohort analysis: your GTM secret weapon

Cohort analysis serves as an operating system for modern GTM teams. It helps operators spot risks early, forecast with confidence, and drive smarter, more sustainable growth.

If revenue quality, retention, and scalable GTM performance matter to you, cohort analysis belongs in your toolkit.

To learn more about cohort analysis and ARR waterfalls, check out our conversation with Will Sullivan.