Experts give their takes on how RevOps teams can support growth from $0-$100M+

RevOps builds credibility by successfully owning the GTM data foundation used by leadership to make key decisions in the pursuit of scalable growth. Since this requires aligning people, process, data, and systems, it’s critical for RevOps to cut through the noise and focus on what truly matters.

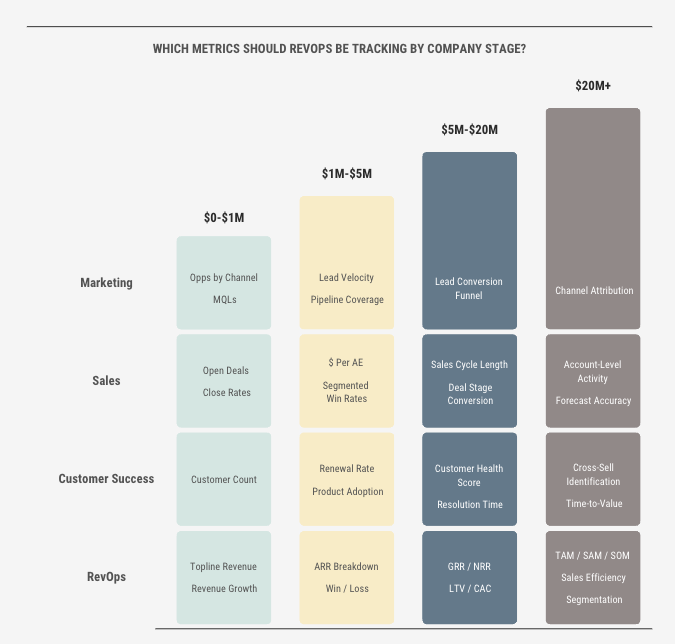

The most valuable metrics vary based on company scale and growth stage. Thinking one step ahead ensures your team is prepared for what’s next.

We polled four experienced RevOps leaders across different stages to uncover the most meaningful metrics. This report consolidates their insights: which metrics to prioritize, why they matter, and how to define them.

These metrics serve as a starting point. If you have the bandwidth and resources, diving deeper into analytics can provide even greater insights. But at a minimum, these are the key RevOps metrics every team needs to track.

Table of Contents:

- Early days: <$1M in revenue

- Foundation building: $1M – $5M

- Growth engine: $5M – $20M

- Road to predictability: $20M+

Key RevOps metrics by company stage

Early days: <$1M in revenue

For companies under $1M in revenue, RevOps is usually still an afterthought. Most don’t have a full-time RevOps hire, and bandwidth is limited. The focus is on finding product-market fit and building foundational processes.

At this stage, teams should prioritize the basics: clean GTM data that supports essential traction metrics for organization, planning, and basic investor reporting.

Open Deals

Definition

- Sum of open opportunities (opps)

- Opportunities can be defined loosely as any scheduled sales conversation, but applying a Stage 1 filter for qualified deals improves meaningfulness of the metric

Purpose

- Prevent deals from slipping through the cracks in day-to-day execution

- Track a basic pipeline metric to measure GTM momentum

Tip

Deals must be created in the CRM for this metric to work. Third-party lead routing tools can automate this, but a simple 10-minute weekly check-in or calendar audit ensures consistency.

“Teams are running on lots of qualitative information (“vibes”) at this point.

It’s best to focus on having a clean, easy-to-use tracking mechanism (CRM) and not focus TOO much on metrics at this early stage.

The single best metric is likely just the number and quality of conversations with prospects. From there, you can start to shape your Ideal Customer Profile.”

Alex Miller, Director of Revenue Operations at Medallion

Close Rate

Definition

- Closed Won Opps / (Closed Won Opps + Closed Lost Opps) in a period

- As with Open Deals, applying a Stage 1 filter for qualified deals improves accuracy

Purpose

- Benchmarks how many opportunities you need to create to hit revenue goals

- Helps test messaging and positioning adjustments, which are frequent in early-stage sales

Marketing Qualified Leads (MQLs)

Definition

- Leads that meet specific engagement criteria signaling potential interest, such as:

- Downloading relevant content (e.g., whitepapers, case studies)

- Repeated website visits or time spent on high-intent pages (pricing, demo request)

- Engaging with marketing emails or webinars

- Meeting firmographic or demographic criteria (e.g., ICP match)

- Typically scored based on interactions, with a threshold that qualifies them for sales outreach

Purpose

- Identify leads that show strong buying intent and are worth passing to sales

- Improve conversion rates by ensuring sales reps focus on leads with the highest likelihood of closing

- Provide a measurable way to assess marketing effectiveness in driving revenue

Tip

MQLs may be less relevant depending on the start-up’s GTM activities in the early days, but MQLs should be tracked as soon as marketing data is collected.

Opportunities Created by Channel

Definition

- Sum of opportunities created in a given period, segmented by channel (e.g., outbound, LinkedIn, inbound, paid ads)

Purpose

- Provides a key output metric for time and money spent on marketing and outbound efforts

- Helps guide monthly or quarterly marketing ROI reviews and future budget allocation

“At a smaller stage company, your revenue team, funnel size, and processes are much simpler. There’s not always enough data to provide strategic insights and measure performance, so it’s generally best to keep the GTM metrics simple.“

Oliver Yu, Chief Growth Officer, QCSS Health

Customer Count

Definition

- Sum of active customers

Purpose

- A fundamental yet surprisingly messy metric for early-stage startups

- Essential for investor reporting, billing accuracy, customer communications, and sales outreach exclusions

Tip

While the definition is straightforward, data consistency is a challenge. Common issues include:

- Scattered data across billing, product databases, and CRM

- Unclear customer definitions of freemium, trials, usage-based models, and PLG

- Poor CRM hygiene

To fix this, define “customer” clearly, implement CRM automations for key fields (e.g., start/end dates, renewals), and assign ownership for data centralization and audits.

Topline Revenue & Revenue Growth

Definition

- ARR = Total revenue from existing annual subscriptions + Total revenue from new annual subscriptions + Total revenue from up-sells – Total revenue from down-sells

- If operating on monthly subscriptions, you can use monthly subscription value x 12

- ARR growth =

- (ARR today / ARR 12 mo ago) – 1

- Recognized Revenue = (Total contract value / contract duration in months) x months active in period

Purpose

- The best traction metric and a top priority for early-stage investors (alongside customer and user count)

- While not as cash-precise as cash flow, it serves as a high-level benchmark for sustainable expense levels for the business

“At this stage, getting each metric to be 100% accurate isn’t the goal. Getting into the habit of tracking your most critical metrics is much more important long-term.”

Josh McClanahan, Co-Founder & CEO, AccountAim

Foundation building: $1M – $5M

At this stage, RevOps becomes necessary. Companies may have raised a Series A, they often begin expanding the GTM team, and there is enough historical data to get analytical. Leadership is seeking repeatability and the beginnings of forecastability at this stage.

The priority is still bringing in revenue and retaining customers, but now there’s a stronger emphasis on process and data-driven decision-making.

“Management is still laser focused on simply getting business in the door and keeping it.

There isn’t a ton of bandwidth to invest heavily in analytics, but basic measures that provide visibility into closing and retaining business are hugely important.”

Katherine Zhang, CEO, OPEXEngine

Attainment by AE

Definition

- Sum of closed won ARR by rep

Purpose

- Moving beyond founder-led sales, startups need to assess sales rep performance and identify areas for investment

- The goal is to get AEs hitting quota and becoming ROI-positive

- The simplest way to track this is ARR closed per rep

Tip

Don’t view AE attainment in isolation.

Compare it to:

- Quota to measure performance

- All-in seller costs to assess ROI and guide future hiring decisions

Close Rates by Segment

Definition

- Closed Won Opps / (Closed Won Opps + Closed Lost Opps) in a period, filterable by key segment parameters

- It’s important to have this segment data enriched in your CRM. Bonus points if it’s snapshotted on the opportunity so you can truly see the make-up of a deal at the time of the sale process

Purpose

- Companies should track close rates from day one, but at the scaling stage, it’s critical to segment by:

- Company size, industry, buyer persona, use case, and competitive landscape

- This analysis helps leadership answer:

- Who is our Ideal Customer Profile?

- Where are we losing deals?

- Are there messaging or product gap

Pipeline Coverage

Definition

- Total weighted pipeline value with close date in period / quota for the period

- Pipeline is weighted based on likelihood to close by stage of deal

Purpose

- Even with pipeline data quality challenges, tracking pipeline coverage helps build sales and marketing discipline

- Coverage ratios act as warning signals. If low, reps are at risk of missing quota

Tip

Having trouble setting up close rate analysis in the CRM? Use our sheets-based ICP analysis template

Download here

Lead Velocity by Channel

Definition

- (Month 2 qualified leads – Month 1 qualified leads) / Month 1 qualified leads

- It can be helpful to review this by channel as well, especially if channels have notably different deal conversion rates

Purpose

- Lead velocity measures growth in qualified leads entering the pipeline, a leading indicator for future revenue

- Early-stage startups often struggle with pipeline data quality, making lead velocity a more reliable growth metric

- If lead velocity grows 7% in Month 2, sales should expect a 7% increase in revenue in the period following the average sales cycle length

Tip

3-4x pipeline coverage is a common benchmark, but adjust based on historical close rates

Example: A 25% close rate means you need 4x coverage to hit quota

Renewal Rate & Churn Rate

Definition

- Customer renewal rate: renewed customers / customers up for renewal

- Revenue renewal rate: Renewed revenue / revenue up for renewal

- Churn rate: 1 – renewal rate

Purpose

- With revenue growth underway, retaining customers is crucial for scaling efficiently

- Churn analysis helps identify problems in:

- Product adoption

- Customer success strategies

- Fit between product and market needs

- Investors (especially at Series B and beyond) pay close attention to renewal rates

Tip

Revenue renewal rate can be tracked as “Gross” where you exclude any up-sell in the numerator, or “Net,” where you include up-sell

It’s important to track both because one or two big up-sells, while great, can mask poor renewal rates for a large chunk of the business

“Many companies move too quickly to focusing on gross and net revenue retention of the entire ARR base. This can be a mistake.

Companies should prioritize looking at retention based on the business that is up for renewal in a given period. NRR or GRR can be misleading if you go through a quarter with nothing up for renewal. You think you did great, but actually there was just nothing to do. When you’re smaller, you want to be more immediate action-oriented.”

Katherine Zhang, CEO, OPEXEngine

Product Adoption

Definition

- Product adoption varies by company, but a common thread is that product analytics must be tied to customer accounts in your CRM so field reps can take action

Purpose

- As the customer base scales, tracking active usage is key to identifying churn risks early

ARR Growth (New & Expansion)

Definition

- New ARR: Total ARR from new customers (no prior contracts)

- Expansion ARR: Additional revenue generated from existing customers

Purpose

- Evaluate if revenue growth is balanced between:

- New customer acquisition

- Expansion revenue from existing customers

- If expansion is lagging, this signals potential CX, product adoption, or sales process issues

“When you’re still figuring out your product marketing at this stage, win/loss detail is gold for understanding where to double down in positioning vs. where to pivot messaging.”

James Geyer, Co-Founder & COO, AccountAim

Win / Loss Rationale

Definition

- Win Reasons: % of closed-won deals by reason

- Loss Reasons: % of closed-lost deals by reason (e.g., price, features, competition)

Purpose

- Refine GTM strategy by analyzing why deals are won or lost

- Outcomes influence:

- ICP adjustments

- Messaging improvements

- Pricing strategy

- Product roadmap decisions

Tip

It is important to get a complete data set for this analysis. This requires sellers to get feedback from buyers on the rationale – which isn’t always honest – and to actually input the info into the CRM

Growth engine: $5M – $20M

At this stage, poor Revenue Operations can stall growth. Without a clear understanding of sales and marketing funnels by segment and early sales efficiency metrics, GTM teams risk focusing on the wrong areas.

Even if a company continues growing without strong RevOps, the cost of neglect rises. Operational and tech debt compound, making it increasingly difficult to implement scalable processes later.

Sales Cycle Length

Definition

- Average time from first sales interaction to closed deal

- (Sum of the total number of days it took for each won deal to close in the period) / (# of deals won in the period)

- Total number of days to close calculated as (Opp Close Date – Opp Create Date)

Purpose

- Companies may track sales cycles before hitting $5M, but at this stage, it becomes a critical input for accurate forecasting and pipeline reviews

- A slipping sales cycle can signal deal progression bottlenecks, such as:

- Competitive evaluations

- Longer security or procurement processes

- Poor sales training

Deal Stage Conversion

Definition

- Stage-to-Stage Conversion Rate:

- Deals advanced to next stage / (Total deals advanced + Deals lost in period)

- Average Time in Stage:

- Sum of days in stage for deals advanced and lost / Total deals advanced or lost

Purpose

- Tracks how efficiently deals move through the sales funnel

- Helps GTM teams identify bottlenecks, improve processes, and increase close rates

Tip

Salesforce and HubSpot offer basic reporting on stage progression

AccountAim provides deeper historical analysis without custom queries

“If you can build RevOps infrastructure with growth in mind before $10M ARR, scaling beyond $20M becomes significantly easier.

The larger you get, the harder it is to adapt legacy systems for the data and processes RevOps needs to be truly effective, often requiring a full overhaul of people, process, and technology.”

Oliver Yu, Chief Growth Officer, QCSS Health

Lead Conversion Rates

Definition

- Lead to MQL Conversion = MQLs created / Total leads generated

- MQL to SQL Conversion = SQLs created / MQLs generated

- SQL to Opp Conversion = Opportunities created / SQLs generated

Purpose

- Measures how effectively marketing efforts generate qualified leads and move them through the funnel

- Helps RevOps guide marketing teams on demand generation spend and strategy

Tip

Long lead conversion cycles may suggest you should compare lead conversion over time.

For example, if it takes 2mo for an avg MQL to convert to an SQL, comparing SQLs in month 3 vs. MQLs in month 1 might make sense.

Customer Health Scores

Definition

- Identify key indicators of customer health, such as:

- Support tickets

- Product usage

- Qualitative customer feedback

- Survey results

- Seat expansion or reduction

- Organizational changes

- Assign numerical health scores (1-5) to each indicator based on metric thresholds

- For example, no product usage would likely be assigned a “1” as that is typically unhealthy behavior

- Weight each metric in your score: depending on which indicators are most correlated with customer health, weight them accordingly. The sum total of the weights should equal 100%

Purpose

- Predicts retention, expansion, and churn risk by analyzing customer engagement and success signals

- Helps teams prioritize customer outreach

- Most companies adopt this once they reach data maturity or when customer count scales large enough to make keeping track of customer context difficult

Tip

Gut understanding is better than nothing for picking these metrics, but it is even more powerful if there is data supporting the correlation of each data point with churn or upsell.

Resolution Time

Definition

- Average resolution time:

- (Total hours to resolve all tickets) / Total tickets resolved

- Time to first reply:

- (Total time to first response across all tickets) / Total tickets received

Purpose

- As customer scale grows, slow support responses can erode goodwill

- Tracking resolution time and first-response time keeps Support leadership accountable

LTV / CAC (Lifetime Value to Customer Acquisition Cost)

Definition

- LTV = (ARPA x Gross Margin) / Churn Rate

- CAC = Total Sales & Marketing Spend in period / New Customers Acquired in period

Purpose

- Lifetime Value (LTV) to Customer Acquisition Cost (CAC) is a single metric to evaluate profitability, efficiency, and sustainability of a company’s GTM motion. It answers how much value a customer generates for a business over their estimated lifetime compared to the cost of acquiring them

- In later stage businesses, investors will also heavily scrutinize this metric and seek benchmarks greater than 3. Anything below 1 indicates a business is unsustainable

Revenue Retention (Gross & Net)

Definition

- Gross Revenue Retention (GRR) excludes expansion revenue:

- (Starting ARR in period – Churned/Down-sold ARR in period) / Starting ARR

- Net Revenue Retention (NRR) includes expansion revenue:

- (Starting ARR in period – Churned/Down-sold ARR in period + Expansion ARR in period) / Starting ARR in period

- Note that these definitions exclude new ARR sold in each period

Purpose

- An investor favorite, revenue retention tells you how much of your existing revenue base you are retaining each month, quarter, or year. It indicates a base level of growth (or negative growth) a company experiences without any net new sales. With net revenue retention > 100%, the best SaaS companies continue to grow even without new sales

- For operators, it is a measure of how well the customer experience is working post-sale, encompassing product stickiness and CX effectiveness

Tip

Many companies and investors monitor cohorted revenue retention as well, tracking improvements in revenue retention over time based on customer start-date buckets

Road to predictability: $20M+

At $20M+ in revenue, companies must implement structured analytics to create visibility and repeatability across GTM teams. At this stage, leadership and investors expect predictable growth, meaning RevOps must shift from reactive reporting to proactive, forward-looking analytics.

Many leaders state they need their RevOps team to “see around corners” and predict business outcomes, course correcting when necessary. Accurate forecasting, sales efficiency, and data-driven decision-making separate high-performing teams from those struggling to scale.

“Once you’ve hit $20M, you’re probably on the right path. At this point, I’d focus most on the block and tackle metrics that allow you to improve the weakest part of your GTM motion.

Depending on the business, it’s probably a few metrics relevant to each critical juncture of the “bowtie” – the narrowing of the lead funnel to closed business, followed by renewal and expansion of customers.”

Lonny Sternberg, VP of Revenue Operations and GTM Leader

Account-Level Activity

Definition

- Account-level activity is less of a specific metric and more of a data tracking and presentation exercise

- Companies should be able to report total sales and marketing touches along with their funnel metrics (meetings, opps, open opps) and conversion rates at the account level

Purpose

- As the sales team gets larger and TAM gets worked through, it’s important to ensure reps are working their best accounts deeply

- CRM Last Activity Dates become insufficient measures of account coverage because they can be gamed

- Account-level activity also supports ABM initiatives

Tip

A leading public SaaS company summarizes this info by rolling it up into account tiers, so managers can make sure that their reps are spending their time on the highest ROI prospects. They benchmark the average activity required to generate an opp and drive their reps toward it for each account

Forecast Accuracy

Definition

- Formula: 1 – Absolute value (Actual Revenue – Forecasted Revenue) / Actual Revenue

- Note: This is different than other rates of change because we want to understand how far our forecast was from the actual result in our forecast, not vice versa. We use an absolute value because forecast accuracy should never be negative

Purpose

- Forecast accuracy becomes more and more important the larger a business grows as investors – especially public investors – react strongly to missed forecasts

- An accurate forecast proves that management knows the levers of the company’s GTM process and how to influence them

- Understanding forecast accuracy is the first step to improving it. It drives revenue predictability, sales and marketing alignment, and rep forecasting methodologies

Channel Attribution

Definition

- First-touch and last-touch attribution is simple: the single touch of choice gets all of the credit for the conversion event

Purpose

- Measures which marketing and sales channels contribute to pipeline and revenue, helping RevOps teams optimize budget allocation, lead quality, and GTM strategy

Considerations

- Multi-touch attribution is generally recommended and there are two popular definitions:

- U-Shaped: First touch (40%) and lead creation (40%) get most credit, with 20% spread across middle touches

- Used primarily in demand generation and inbound-led businesses as it balances brand awareness of the first touch with lead conversion (pipeline creation in this case)

- U-Shaped: First touch (40%) and lead creation (40%) get most credit, with 20% spread across middle touches

- W-Shaped: First touch (30%), lead creation (30%), and opportunity creation (30%) get most credit, with 10% spread across middle touches.

- Used primarily in sales-led GTM motions as it captures both marketing and SDR/sales engagement

Cross-Sell Identification

Definition

- There are two enabling metrics for cross-sell:

- Cross-sell likelihood: can be built into our earlier definition of customer health score. Based on engagement levels with the existing product, time spent with the business, or team dynamics, scores can be built to flag accounts likely ripe for expansion

- Product penetration: shows which products a customer is already using. While it differs by company, best practice usually includes creating separate opportunities for each product and ensuring the CRM, billing, and product analytics tools are all synced to have a clear source of record for product penetration.

Purpose

- Multi-product data is hard for field reps to easily analyze. Cross-sell identification analysis makes it easy for managers and field reps to action this information.

Time-to-Value (TTV)

Definition

- There are two enabling metrics for cross-sell:

- The definition is simple: (Date value realized – contract start date)

- But the assumptions and definitions are challenging and bespoke to each business

- What is “value” for your product?

- For some businesses it’s easy – a spend management platform might realize savings for their client or a lead gen agency might generate opportunities. For others it’s less clear

- How do you measure “value”?

- For some companies, a certain product action might indicate value and for others completing a lengthy “go-live” process might indicate value

Purpose

- Measures how long it takes for a new customer to experience value post-purchase and often correlates heavily with (early) churn risk

- It is used as a single metric to measure the post-sale experience: implementation, onboarding, usage

Analytical Segmentation

Definition

- As a company grows – expanding business lines, segments, and geographies – analytics requests proliferate. It no longer makes sense to review consolidated metrics as leaders need specificity to run their business units

Tip

While there are no specific definitions for these analytical cuts, it is strongly advised to keep this reporting need in mind during the early days. It is far easier to include granularity at the time of data foundation creation than to force it in later. This effort includes alignment between finance, data, and GTM teams

TAM / SAM / SOM Analysis

Definition

- Total Addressable Market = sum of potential customers x average deal size

- Many companies will use a high level metric, but TAM becomes more useful for resource planning when you break it down by segment and geography. Many companies will use NCIS data to get a detailed breakdown of US-based accounts by industry and size

- Serviceable Addressable Market = TAM x share of your addressable segments (industries, geos, sizes of companies that you serve)

- Serviceable Obtainable Market = SAM x current or future estimated market share %

Purpose

- Market sizing helps RevOps and executive teams prioritize growth strategies and resource allocation

- Total Addressable Market represents the entire possible market for your product

- Serviceable Addressable Market represents the portion of TAM that your business can feasibly serve based on geography, industry, internal resources, or product fit

- Serviceable Obtainable Market is the actual revenue opportunity for your business based on its market share in the space

Sales Efficiency (SaaS Magic Number)

Definition

- (Current quarter revenue – previous quarter revenue) x 4 / Sales and Marketing Expense in previous quarter

- Note: This should exclude lumpy one-time revenue like professional services

Purpose

- Answers: “For every $1 of S&M spend, how much annual revenue do we earn?”

- The output can be used to determine if your GTM motion warrants further investment. A value >0.75 generally means invest in sales and marketing and <0.5 means you should focus on efficiency instead

“Many leaders focus on TAM, but SAM and SOM are just as critical. Optimizing for SAM and SOM forces companies to confront the constraints of people, processes, systems, and tools. It’s easier to pitch a massive potential market opportunity, but harder to demonstrate how you’ll realistically capture it.

If 10% of your TAM wanted to buy from you this year, could your business deliver an ideal experience? For most companies, the reality is no — and that’s why RevOps needs to be at the table when defining market opportunity, and the strategy to execute against it.”

Lonny Sternberg, VP of Revenue Operations and GTM Leader

Special thanks to our expert contributors

Katherine Zhang is the CEO & GM of OPEXEngine by Bain & Company, the leading performance benchmarking solution for SaaS and software companies. Previously, she spent over a decade building and leading growth strategy and revenue operations teams to scale tech companies including Project44 and Relativity.

Lonny Sternberg has led revenue operations in B2B SaaS organizations for 12+ years, including at Vestwell and AudioEye. He specializes in building and maturing the go-to-market engines required to grow revenue ranging from $0 to $300M+. With deep expertise in scaling cross-functionally alongside Sales, SalesOps, Enablement, Deal Desk, Marketing, Customer Success, and Partnerships, Lonny leads with authenticity, resulting in developing diverse, high-performing teams that are rooted in continued learning and collective success.

Alex Miller is the Director of Revenue Operations at Medallion, a software provider helping healthcare companies streamline their clinician operations. Alex previously led revenue operations for leading technology start-ups Mux and Sendoso. Alex actively advises revenue technology start-ups.

Oliver Yu is the Chief Growth Officer at QCSS Health, the leading software provider to Medicaid MLTSS (managed long term services and support) health plans. Oliver owns marketing, sales, and growth initiatives to scale the business. Previously, Oliver was Vice President of Revenue Operations at Fusion Risk Management, seeing the company through its acquisition by Great Hill Partners.